Mark Olson has been announced as the interim executive director for Alberta’s Western Crop Innovations as it...

Crops

How a Desire to Lead Brought This Wheat Breeder to Alberta

Gurcharn Singh Brar is a wheat breeder whose path meandered from the breadbaskets of Punjab, India, to the sprawling...

The 411 on RVTs

What are the regional variety trials and how can you as a farmer use them to grow the best crops? Editor’s note: This...

Record Highs Across Most Crops Leaves Oats Behind

It has been reported that farmers in Canada are planting more wheat, canola, barley, corn and soybeans, but fewer...

Wildfire Activity Continues in Alberta

While wildfires continue in Alberta, impacting some cropland, there’s some positive news on the horizon. Hot and dry...

Researchers Close to Utilizing Rapeseed For Human Consumption

In the European Union, half of plant proteins come from rapeseed plants. The plant has only previously been used for...

Feds Announce Funding for Grain Drying Projects

The federal government is giving more than $22.2 million to support for 45 new projects related to adopting more...

February Set New Grain Record

Collaboration improved among the grain industry allowing for a shipping record. February 2023 was the best February on...

The BASF Hybrid Wheat Program is Leaving Canada

BASF has decided to cease its activities in hybrid wheat seed development in North America and continue in Europe, the...

Benefits of Diversifying Crop Rotations Revealed in Regional Factsheets

The Western Grains Research Foundation (WGRF) recently announced it has completed 12 regional fact sheets for the...

Consumer Decisions Control the Ugly Produce Movement

What do consumers think about less than perfect produce? The food wasted globally is estimated at 1.6 billion tonnes,...

Global Food Commodity Prices Decline in July, Yet Levels Remain High

The Food and Agriculture Organization of the United Nations (FAO)’s Food Price Index showed a significant decline in...

Delayed Planting Dates Prove to be a Greater Concern than Abiotic Stressors this Season

Corn, soybeans and canola have entered the critical reproductive phase where the production of corn grain, soybean...

Farmers Offered Winter Camelina Contract Production Opportunity

Earlier this month, Yield10 Bioscience announced an open enrollment program targeted at growers for contract...

Genomics Research Projects Receive $12.1 million in Funding

Results Driven Agriculture Research (RDAR), and the federal and Alberta governments, are giving $5.1 million in...

Canary Seed to Become an Official Grain in Canada

Photo: Diverse Field Crops Cluster Canary seed will be designated as an official grain under the Canada Grain Act as...

The Future of Farming Is Counting on Good Communicators

It can feel like farmers are being attacked from every angle, and often it feels undeserved. While agriculturalists...

As the Plant-Based Food Market Surges, the Lupin Bean is a Rising Star

Lupin bean pods. Photo: Koralta The following piece is from our sister publication, Germination. According to a new...

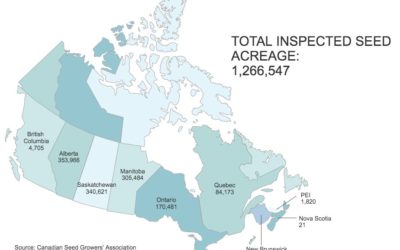

Canada’s Seed Landscape: Analysis and Insights

A snapshot of the number of inspected seed acres by province in 2020. Photo: Marc Zienkiewicz The following piece is...

Peace, Central Crop Prospects Dimmed Due to Excessive Moisture

Crops in the Peace River district and central Alberta have had their potential limited due to excessive moisture and...