CropLife International and the American Seed Trade Association (ASTA) launched an animated video exploring the history...

Advancing Seed

PGDC on the Cutting-Edge

Gene editing and climate change were major topics on the agenda at this year’s meeting of the Prairie Grain...

LCRC receives recommendation for interim registration on first variety

The first variety from Limagrain Cereals Research Canada's (LCRC) cereal breeding program has been recommended for...

Advancing Crop Research

WGRF’s funding is all about benefitting western Canadian crop growers. Farmer-focused. Research-focused. Multi-crop....

Share Your Vision, Shape Your Industry

Be part of the discussion as the CSGA and Canadian seed industry engages its membership online. In July 2016, the...

Solving the Problem of Hard Seeds

Beans are primarily sold as a dry commodity, and therefore, visual seed quality is important – an intact seed coat,...

New test genetically identifies fungal wheat threat

A team of U.S. Department of Agriculture (USDA) and university scientists has developed a sensitive new assay method...

Plant scientists identify gene to combat crippling wheat disease

A major breakthrough in the cloning of a resistance gene to eliminate wheat scab — a widespread disease responsible...

Canadian Seed Trade Association Releases Coexistence Plan for Alfalfa Hay

Following extensive consultation with stakeholders along the alfalfa hay production chain in Western Canada,...

WGRF Invests $800,000 in U of A Wheat Breeding

The Western Grains Research Foundation (WGRF) and the University of Alberta’s Faculty of Agricultural, life &...

Feds Announce Support for New Genomic Application Projects

A $4.2 million federal investment for four new projects that will use genomic technologies to drive innovation and...

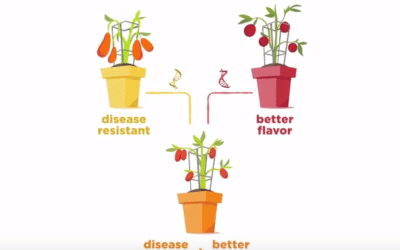

Plant Breeding 101

The process of plant breeding can be a long and complicated one, but we talk to three experts who boil it all down....

Lists of Prairie Grain Development Committee (PGDC) Supported Cultivars

This year the Prairie Grain Development Committee met Feb. 23-25 in Banff, Alta., to review new cultivars and put...

A New Path Forward

There are many moving pieces in the Canadian seed industry today — changes to Plant Breeders’ Rights legislation,...